(And How You Can Too)

As a real estate investor, closing on a property is one of the most exciting steps, but it’s also when costly mistakes can slip through if you’re not careful. Recently, I closed on a property in Denver, and during the process, I discovered a $24,000 mistake in the closing documents. Had I not caught it, I would have been in serious trouble down the line. Here’s how it happened and what you can learn from my experience to avoid similar mistakes in your own deals.

The Importance of Reviewing Your Closing Documents

Whenever you’re doing a closing you’ll need to pay extra attention to the paperwork that comes your way. In my case, the closing company sent over all the documents ahead of time, and I made sure to review every page carefully. This isn’t a step you want to rush or overlook.

One of the most crucial documents you’ll encounter is the HUD-1 Settlement Statement (some places call it an ALTA), which breaks down the sale price, closing costs, title insurance, and every expense associated with the transaction. There are also the loan documents. This is where I found a major discrepancy: the balloon payment on the second mortgage was $144,000, when it should have been $120,000.

How I Found the Error

The error I caught involved a second mortgage on the property, a seller finance note with a 0% interest rate and a balloon payment at the end of five years. According to the contract, I would pay $400 a month for 60 months, which totals $24,000 of principal paydown. The remaining balloon payment should have been $120,000, but the documents listed it as $144,000.

Had I not double-checked this detail, I would have ended up owing an additional $24,000 in 5 years! I wouldn’t have known about it until I had to pay the balloon. Imagine how shocking and painful that would have been! This is why document review is so critical—mistakes can be small but have huge financial implications.

What to Do If You Find a Mistake

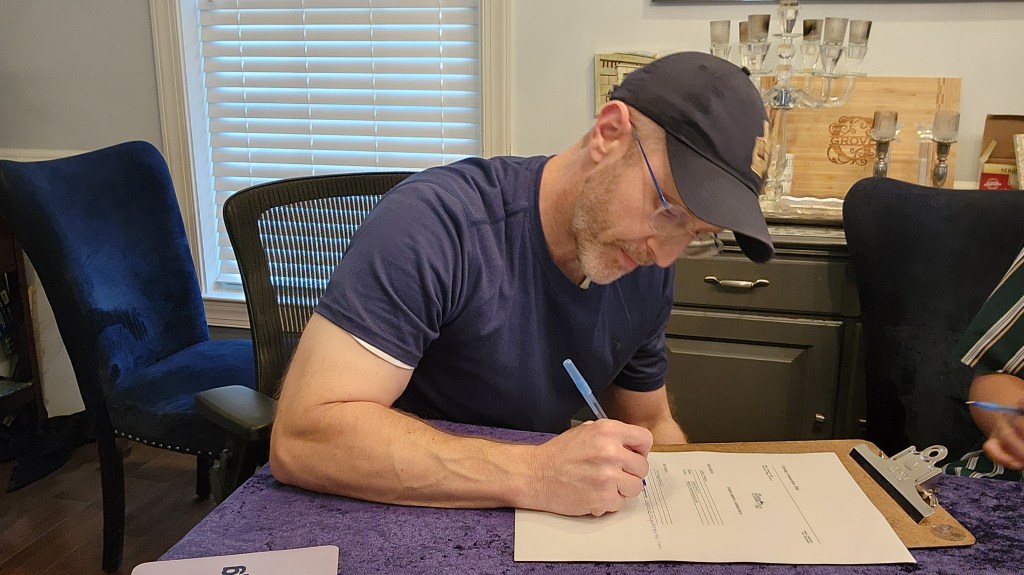

If you find a mistake, don’t panic—just take action quickly. In my case, we paused the signing, notified the title company, and got the documents revised before moving forward. Usually, as in this case, this can be fixed with a quick document edit. If you have to reschedule the closing, that’s not a big deal. You just need to have the title company or closing attorney amend the original contract to extend the closing date which gives time to fix the mistakes.

The Value of Checking Every Detail

At the end of the day, this experience reinforced the importance of careful review. It’s easy to get caught up in the excitement of closing a deal, but overlooking details can lead to costly consequences. Take your time, cross-check the documents, and if something doesn’t add up, speak up.

Closing Thoughts and What’s Next

With the documents fixed, I signed the papers and the house is officially ours! We’re now starting renovations to transform it into a 7-bedroom co-living space, which should bring in solid cash flow. The next steps are lining up the contractors and property manager to get everything in place.

And, as always, if you’re interested in investing in a deal like this one, schedule a time to chat.

Leave a comment