Hey there future real estate moguls! In this post, we’ll dive into the not-so-secret sauce of real estate success: Cash-on-Cash Returns. It might sound like jargon, but fear not – we’re here to break it down in a way that even your grandma would nod along approvingly.

The Significance of Cash on Cash Returns

Consider, if you will, the scenario: you have secured a promising investment property. Now, the pertinent question arises – “How do I know if this is a profitable investment?” Enter the protagonist of our discourse – Cash on Cash Returns (CoC). This indispensable tool empowers investors to gauge the performance of their investment with mathematical precision.

Fundamentals: Decoding Cash on Cash Return

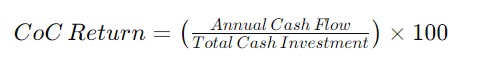

CoC mirrors the concept of Return on Investment (ROI) but only focuses on one aspect of the ROI. It tells you the percentage of cash income received relative to the total cash investment. The formula, though seemingly complex, is elegantly succinct:

In essence, this formula illuminates the response to a pivotal inquiry: “What proportion of my invested capital am I realizing annually?” This does not include the other wonderful ways you can make money in real estate such as appreciation and loan paydown, but it is a good measure of the profitability of ad eal.

Deconstructing the Formula:

1. Annual Cash Flow:

- This comprises the tangible cash influx accrued from the property annually. Essentially, you take the annual rental income and subtract operational expenses such as taxes, maintenance, and mortgage.

2. Total Cash Investment:

- This encapsulates the aggregate sum of capital injected into the investment. The cost of entry – which we will break down in another post. The biggest contributors are the down payment, closing costs, and any initial rehab or repair costs.

3. Computation:

- Now just take #1 and divide by #2. Multiply by 100 to get a percentage.

The Significance of CoC Returns:

- Rapid Evaluation: CoC give a fast and clear assessment of the investment’s profitability

- Comparative Analysis: Comparing CoC Returns allows for a direct comparison of potential investments to help you choose the best option.

- Risk Stratification: Knowing cash returns aids in risk evaluation. The higher the returns the greater your reserve to tolerate unexpected expenses.

What is a Good CoC Return:

This is a very personal question and will vary depending on your long term goals and the individual deal. One thing you can do is compare the cash on cash return of a deal to the equivalent returns of an exchange fund or large cap mutual fund which would probably be 6-10% depending on the mix of stocks and bonds. If you can get the same thing or better with the CoC and then throw in all the other source of return on investment you’re doing pretty well. 🏢📈💼

Leave a comment